Read the rest of the post ' Securing a sustainable reinsurance market for renewables '

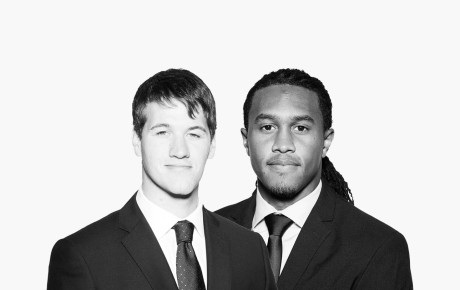

Busting common myths about a career in actuarial science

Actuarial science is a field that is often misunderstood. Contrary to popular belief, it’s not full of wallflowers and independent workers. In fact, it’s one of the most interactive and exciting roles in reinsurance. Deondre Trott – one of our shining actuarial stars at Hiscox Re & ILS – busts some common myths about a career in the field and illustrates the reality of being an actuarial analyst.

It’s one of the most collaborative roles in reinsurance

When I was first considering my future career, one of the more frequent opinions I heard about actuaries is that they’re quiet and tend to work alone. In reality, I’ve found the opposite is true! One of my favourite things about being an actuarial analyst is that you get to interact with all types of people throughout the business. In a single day, I get to talk to underwriters and contract specialists, through to catastrophe modellers and ILS portfolio managers. Every day is different, but always extremely collaborative!

Your career is always evolving and you’re constantly learning

One of the most exciting parts of being an actuary is that you’re not confined to one type of role. Actuaries can focus on a very broad range of areas from pricing and capital modelling, to reserving and risk analysis. So, even though I’m currently in the pricing field, it’s exciting to know there are many other roles that can move into if I ever want a new challenge. Another part I love about being an actuary is that our job allows us to learn and interact with multiple parts of the business outside of Re & ILS. This exposure gives me an opportunity to ask questions and learn about other areas and risks, so I’m constantly building my industry knowledge and technical expertise.

Being an actuary is so much more than life, pensions, and health

When I first got offered a position at Hiscox Re & ILS, I also had the option to work for a life reinsurance company that I was already interning at. I chose Hiscox because I always wanted to be in property and casualty (P&C). For me, this ultimately came down to the type of risks that the company would be covering. I found the idea of exploring and analysing risks such as hurricanes, wildfires, and medical malpractice much more thrilling.

I also felt the P&C environment can change more frequently due to constantly emerging global risks. For example, how can we change our pricing analysis due to increase in wildfire activity and the impact of climate change in the US? And even as we speak, to what extent will the COVID-19 pandemic impact how the insurance industry looks at communicable diseases in the future? There’s never a dull moment in P&C.

It’s not all number crunching

One of my favourite things that I’ve ever done at Hiscox Re & ILS was running with 10 other co-workers from Bermuda and London in the Ragnar Reach the Beach Relay in New Hampshire. Over the course of 24 hours, 11 of us ran 200 miles from Bretton Woods to Hampton Beach, raising over $7,000 for Action on Alzheimer’s and Dementia Bermuda. We pushed ourselves outside of our comfort zone both physically and mentally, sleeping overnight in a van, eating copious amounts of bananas and peanut butter, and having endless laughs along the way. It was definitely one of the more unique things I’ve done during my time with Hiscox and it was something entirely new for me. Running at 2am in the morning in a different country was surprisingly enjoyable and peaceful.

A mathematical background is a useful starting point

If I was asked what an actuary does in a few words, I would say that the main task that they perform (regardless of where they work) is to quantify risk, which means you need to have a strong background in statistics. This is usually demonstrated by having at least a bachelor’s degree in actuarial science, statistics, or mathematics. Ultimately, my goal is to become a fully qualified P&C actuary. This is achieved by attaining a fellowship in an actuarial organisation, two of the most common are Fellow of the Casualty Actuarial Society (FCAS) in the United States – which which is what I’m currently pursuing – and Fellow of the Institute of Actuaries (FIA) in the UK.

We work hard and play hard

Hiscox understands that people have lives outside of work. Although my life as an actuarial analyst is challenging and busy, I still have plenty of time to do the things I love. My favourite activity outside of work is to play football. It’s something I’ve done for fun and competitively since I was four years old. Now I casually play once or twice a week with some friends, and it’s great way for me to reduce stress and stay in shape.